Monday, April 29, 2024

Sunday, April 28, 2024

Saturday, April 27, 2024

Gaza ‘solidarity encampment’ shakes up Northwestern campus but leaves no clear winners

Gaza ‘solidarity encampment’ shakes

up Northwestern campus but leaves no clear winners

Jewish students unnerved, but defiant;

pro-Palestinians enjoy growing numbers, but demands unmet; university head

avoids punishing violators but still accused of ‘genocide’ by demonstrators

By JACOB MAGID

FOLLOW

26 April 2024, 5:09 pm

EVANSTON, Illinois — The

crowd of several hundred Northwestern University students at the newly

established “Gaza Solidarity Encampment” erupted in cheers Thursday morning as

an approaching car loudly honked in apparent support of their cause.

But then the vehicle

turned onto the road adjacent to the suburban Chicago school’s quad, entering

the pro-Palestinian protesters’ line of sight, where it could be identified as

a firetruck.

The honking, therefore,

was likely more a case of standard procedure for clearing a congested street

when responding to a 9-1-1 call than an endorsement of the protesters’ key

demand that the university divest from Israeli institutions.

And so it seemed like an

apt snapshot for a day in which no side really came out and victories were at

best imagined.

Because while the

protesters managed to balloon from several dozen at 7 a.m. to a crowd of well

nearly 1,000 by nightfall, a school administrator speaking to The Times of

Israel on condition of anonymity said the chances of the students’ demands being met remained close to nil.

As for Jewish students

on campus, they might have been able to take initial solace in the university’s

decision to bar the tents erected at the start of the protest, but that

ordinance went largely unenforced. By midnight, the number of outlawed tents had

swelled to roughly 80, and anti-Israel chants rang out from similarly

unapproved megaphones on repeat.

“Hey, hey. Ho ho. Israel

has got to go!”

“From the river to the

sea, Palestine will be free!”

“Long live the

Intifada!”

In a correspondingly

no-win situation was Northwestern President Michael Schill, who is still in his

first year on the job. The 65-year-old legal scholar is trying to prevent the

campus from descending into the type of chaos seen through the past week at

Columbia University. There, his counterpart dispatched the NYPD to clear an

anti-Israel encampment in what led to the arrests of over 100 students and the

sparking of a national protest movement.

Ostensibly recognizing

that another aggressive crackdown would not calm the campus temperature, Schill

withheld enforcement of the updated code of conduct.

This did not shield him

from the anti-Israel protesters’ chants of “Schill, Schill, you can’t hide. We

charge you with genocide!”

Masking their identities

The protest was well

organized from the outset, with organizers donning yellow traffic vests and

effectively communicating with participants via megaphones and social media.

Participants were

instructed to form a ring around the encampment to serve as human shields if

campus police — who were at the site periodically throughout the day — were

ordered to try and remove the tents. This was enough to thwart one such

directive in the morning, which led to a minor scuffle, and authorities didn’t

try again for the rest of the day.

Student groups

supporting the action sponsored water and snacks for participants, many of whom

skipped class to stay at the encampment all day. Nearly 100 were still on site

Friday morning, receiving “arrest training” to be ready for the event that police would move in a

second time.

Organizers pledged to

remain on Deering Meadow quad until the university condemned what they said has

been its censorship of pro-Palestine speech and ceased all academic

partnerships and investments in Israeli groups and companies.

Nearly all protesters

covered their faces with either COVID masks or Palestinian keffiyehs, which

several participants said were designed to prevent them from being identified.

They were also all

coached not to speak with the media, and each of the many journalists on

campus was diverted to one of the organizers.

This writer was

repeatedly refused interviews when identifying as a Times of Israel reporter.

“Since that’s an Israeli propaganda tool, that’s not going to have a place

here,” one of the organizers said.

Nonetheless, the mood on

the quad was light for much of the day. Music blasted from loudspeakers; some

participants learned and performed the dabke Palestinian folk

dance; incenses were passed around at one point in the afternoon.

Curious onlookers

stopped to take pictures before continuing to their classes at the surrounding

lecture halls.

How representative?

The protest was located

on south campus, where humanities majors are largely based. Students in this

half of the university were said to be more politically active, with sympathies

leaning more toward the Palestinian side of the conflict. North campus largely

houses STEM students, who were said to generally be more indifferent about such

issues.

Still, students were

split over how representative those occupying the quad were of the broader

campus position on the war in Gaza and the Israeli-Palestinian conflict more

broadly.

Firmly pro-Israel

students insisted the encampment amounted to a vocal minority.

“I think a lot of these

people aren’t even Northwestern students,” said senior Josh Miller.

A handful of older local

Evanston residents were seen waving Palestinian flags on the outskirts of the

encampment, which also housed graduate students and faculty. One participant

wearing a sweatshirt featuring Hamas spokesperson Abu Obeida said he was “affiliated”

with the university and declined to elaborate.

One onlooking Jewish

student who asked to remain anonymous told The Times of Israel in the morning

that most people on campus don’t have an opinion on the Israeli-Palestinian

conflict. But as the crowd expanded to nearly 1,000 people around sunset, he reached

back out to correct his stance, saying that even though the overwhelming

majority of Northwestern’s 8,000 undergraduates were not protesting on

Thursday, a majority do care enough to have an opinion on the issue.

What do we want?

Indeed, over 2,300

Wildcats signed onto a resolution listing the protesters’ demands that was

passed — in a 20-2 vote on Wednesday night by the student legislative body.

(The two nay votes were Hillel and college Democrats; nine members abstained.)

“I was surprised that

[so many] signed the petition. I thought this campus was lame and that nobody

did activist stuff, but I guess they do!” said a junior who supported the

protest but asked only to be identified by his first name, Dylan.

He noted that there was

more of a focus at the encampment on calls for divestment from Israel than for

a ceasefire in Gaza, and figured that this was because Northwestern has

virtually no sway over the warring parties.

“They do, however, have

a choice whether or not to cooperate with companies in Israel or support

partnerships with them,” said Dylan, who had to speak up to be heard over an

organizer’s megaphone and the media helicopters flying overhead.

When asked whether

divestment from Israel is an end in of itself, he said it was not. “It’s a

means to an end. I guess a ceasefire is the end.”

“If Northwestern

divested and there was a ceasefire, I think the protest would end,” he said.

Pressed on whether the

ceasefire should be part of the potential hostage deal currently being brokered

by Qatar, Egypt and the US, Dylan said, “No, I don’t even think that Hamas has

to be part of an agreement for [Israel] to agree to stop indiscriminately

bombing.”

“Part of what Hamas

wants is a ceasefire and maybe also an end to the occupation,” Dylan said,

apparently unaware of or indifferent to Hamas’s declared goal of destroying

Israel and its invasion and massacre on October 7. “The hostages are their

leverage, and I do think they should be released if there is a ceasefire,” he

added.

‘Uncomfortable’

Multiple Jewish students

acknowledged being distressed over the day’s protest.

“Today, I feel

uncomfortable and unsafe,” said junior Eden while standing just several feet

away from the ring of anti-Israel students surrounding the tents.

“Yet I can’t help but

stand here and just watch — watch all these people who heard that I was Jewish

and and am not in support of this as they stare at me all of the time,” she

added.

“There are a lot of

people who aren’t forthcoming about their support for Israel… I do tell people

I am, because I’m proud of it,” Eden said.

Later in the afternoon,

she and another student joined an older Jewish local resident who had been

jogging around the encampment since the morning wearing a white t-shirt with an

Israeli flag.

While Northwestern has a

sizable Jewish population, the subset of Modern Orthodox students is smaller.

Yarmulke spottings are

accordingly rarer, save for the campus’s longtime Chabad rabbi, who was seen

watching the protest from the other side of the quad with a group of Jewish

students.

Later in the day,

though, this reporter caught up with Jeremy Berkun, who was making his way

through Deering Meadow en route to class at the music school.

He said he was choosing

to wear a yarmulke Thursday, even though he doesn’t typically do so as a

Conservative Jew, so that his Modern Orthodox friends wouldn’t be alone in

donning them during this more tense period on campus.

“I have had a few

instances of my friends getting their mezuzahs taken off their

doors last semester,” Berkun said.

Along with his more

religious “brothers,” he said he also has a friend who was leading the

anti-Israel protest.

“I’ve had a lot of

discussions with him about how we both think violence is bad, but he posted

that he supports ‘the resistance’ the day after October 7,” Berkun, a

sophomore, said sadly.

But not going anywhere

As Berkun walked through

campus, he was greeted warmly by Jewish and non-Jewish friends.

“I don’t think I would

ever reconsider coming here. I think this is the perfect place for me. No

matter where I was going to be in this country, I was always going to have some

problems on campus. It was just a matter of where.”

“If I was at Columbia,

Yale or Michigan, I’d have the same problems I’m dealing with now. It’s just a

question of how I deal with them, and that’s by being with my Jewish community,

being with Hillel, being with Chabad,” he added.

Freshman Maia Egnal

described a similar sense of comfort at Northwestern even while acknowledging

the uncomfortable, “antisemitic” nature of the day’s protest.

“I have not seen these

people who are out there today protesting loss of civilian life in other

places,” she lamented during an interview at Northwestern Hillel, a block away

from the encampment.

“I’ve been horrified,

horrified, horrified to see the loss of Palestinian life during this war, but I

wouldn’t say that Israel doesn’t deserve to exist over this, the same way I

didn’t say America didn’t deserve to exist over the wars in Afghanistan or Iraq,”

said Egnal who is involved in the school’s J Street U chapter, which advocates

for a two-state solution.

She discussed sometimes

feeling isolated — particularly since October 7 — between some of the more

hawkish students at Hillel who have branded calls for a ceasefire “antisemitic”

and those at the encampment who “don’t believe Israel should exist.”

“Nonetheless, I love my

Jewish life here,” Egnal said. “My younger sister was just choosing where to go

to college, and I told her that if she came to Northwestern, she would have a

vibrant Jewish life here. She’s committing here today.”

“I will never tell a

Jewish student not to come here, and I think that is probably the attitude of

every Jewish student here. Overwhelmingly, I know that this building will

always support me.”

‘Jewish life is

thriving’

Downstairs, some 150

students were taking advantage of the Passover lunch Hillel was providing

throughout the holiday.

While a large group of

them ate, campus rabbi Jessica Lott shared a few words about the importance of

having both pride and empathy at this moment.

“We serve students

across the political spectrum, including ones who have been involved in the

protest,” Lott said, adding that she had originally scheduled to meet on

Thursday with one of the organizers for a religious lesson, which was canceled

“because she needed to be there [at the encampment] today and I needed to be

here today.”

The campus rabbi

adamantly rejected the notion that the anti-Israel activity was fundamentally

changing life on campus for Jewish students.

Hillel hosted hundreds

of students for Passover seders earlier this week, and there were more students

than ever asking for help to host their own seders in their apartments, she

said, rejecting the suggestion that this was a reaction to October 7 and its

aftermath.

“They’re all excited to

do this and see it as part of adulting. We do it every year, and it has been a

growing program. It’s growing because it’s fun. Regardless of what’s happening

outside,” she said.

“Jewish life on campus

is thriving, and students are finding a way to make their own sense of what’s

going on,” Lott added, suggesting that while Thursday was certainly no win for

Jewish students, they would do just fine regardless.

Antisemitism at Columbia University Is a Disgrace

Antisemitism at Columbia University Is a Disgrace

Imagine if in the wake of 9/11, pro-al-Qaeda

protesters chased New Yorkers out of the city.

By

Andrew

M. Cuomo

April

25, 2024 4:16 pm ET

New York

What is happening at Columbia

University is a disgrace. That it is happening in New York, home to more Jews

than any other city in the world, and at a supposed institution of higher

learning, makes it incomprehensible.

I understand the right to free speech,

the guarantees of the First Amendment, the value of robust debate at academic

institutions. But freedoms aren’t without limits, and much of what is going on

at Columbia isn’t speech at all. Threats, terror tactics and menacing conduct

don’t warrant protection.

Protesters have every right to make

their voices heard. The war in Gaza, the politics of Benjamin Netanyahu’s

government and the elusiveness of Middle East peace are frustrating. These

complicated issues should be discussed and debated. That isn’t the issue at

Columbia. Many of the protesters aren’t pro-Palestinian. They are pro-Hamas and

brazenly support a terrorist organization. The protesters are entitled to their

opinions, even if they embrace undemocratic, bigoted, sadistic, warmongering

thugs. They aren’t entitled to threaten, harass and menace. That isn’t

protected speech; it’s criminal conduct.

Most infuriating is the response of

Columbia’s administration. Jews are at risk on campus and are told not to come

to class—remote learning will be available. Meantime supporters of jihad take

over university property and nosh on pizza.

Seriously? The answer is for the Jews

to flee campus? Imagine, in the wake of 9/11, if New Yorkers had been told to

vacate the city because pro-al-Qaeda protesters were disrupting daily

activities, threatening violence and posing a danger. That is Columbia’s

approach: See you next fall, Jews.

It is the university’s responsibility

to ensure its students are safe. Use campus security. If that is inadequate,

use the New York City Police Department. And if protesters break the law,

arrest, prosecute and expel them.

History can’t be allowed to repeat

itself. The war on the Jews that led to the Holocaust started subtly. Telling

Jews to stay away is shockingly reminiscent of what took place in the 1920s and

1930s in Germany. Jews were excluded from businesses, social activities and,

yes, universities. At the same time, frightened politicians are already

abandoning support of Israel for fear of political reprisal.

This must stop. The Jewish community

needs support in its efforts to mobilize. This is no time for hand wringing.

Regardless of one’s views on Gaza, reasonable people need to open their eyes

and understand this isn’t about the Middle East; it is about America and our

democracy. It is time for full-throated public support for education about the

history of Jews, antisemitism, Israel and the origins of the Palestinian

conflict. It is time for New Yorkers to speak with a single voice in support of

our Jewish brothers and sisters and to demand that Columbia and others, by

their words and actions, reject antisemitism and discrimination against Jews.

The greatest threat on campus is an

ignorant mob, and the greatest threat to the country more broadly is cowardly

indifferent leaders.

Mr. Cuomo, a Democrat, served as

governor of New York, 2011-21.

Tullman And Fitz-Gerald Talk Tech: Capitalize On Tech Sector's Pullbacks

Tullman And Fitz-Gerald Talk Tech: Capitalize On Tech Sector's Pullbacks

Summary

- Howard Tullman, general managing partner at G2T3V, and Keith Fitz-Gerald, principal at the Fitz-Gerald Group, both are long-standing, accomplished investors in public and private technology companies, and both think the big names in this space will continue to dominate over the long term.

- That said, they believe shorter-term issues related to regulation, elections, and growth could continue to impact select names in the shorter term.

- Finally, they discuss the outlook for Meta Platforms, Amazon.com, Alphabet, Microsoft, and others, as well as how the AI boom will sort out in the next few years and the implications for investors.

Tara Moore/DigitalVision via Getty Images

By Mike Larson, Editor-in-Chief, MoneyShow

Transcript

Tullman And Fitz-Gerald Talk Tech: Capitalize On Tech

Sector's Pullbacks

Apr. 27, 2024 6:00 AM ET

By Mike Larson, Editor-in-Chief, MoneyShow

Transcript

Larson - Hello and welcome to our latest MoneyShow

MoneyMasters Podcast segment. I'm Mike Larson, Editor-in-Chief at MoneyShow.

And today we're doubling up with a pair of private and public market investing experts

in the technology sector. They're Howard Tullman, general managing partner at

G2T3V, and Keith Fitz-Gerald, principal at the Fitz-Gerald Group. Gentlemen,

welcome to the podcast.

Fitz-Gerald - Thanks for having me.

Larson - I'll tell you, we had a great discussion going

before we even came on camera here. And I guess that's where I'm going to kick

it off. I mean, in the technology arena, a lot of exciting stuff is going on

out there in terms of the underlying technology, and of course, from a public

market standpoint, a little bit of a stumble here as we start Q2 in that sector and

even some of the Mag Seven names have had trouble all year. So, I don't know

who wants to take it first. But where do you think we are in this technology

cycle again, both from a public and private market perspective?

Fitz-Gerald - Well, I'd like to go back just to where

we were when we started because one of the things Howard and I were talking

about, Mike, before we kicked on here was this legacy of tech. People think

that it's all about today. But Howard and I've been around a long time, and

we've been doing this a long time. And we're talking about some of the things

in the trenches, you know, with Microsoft (MSFT) and Intel (INTC). I mean, Howard, what do you think?

Tullman - Well, what I was going to say -- because what

we were talking about is feature integration and what I am concerned about it

because we're a venture fund as well. And so we look at these startups and I

say to them, your entire life is dependent on either "we will fold you in

or we will crush you." We've got four or five platforms, and they're just

out there, and it's like a candy store. You look at Facebook (META) and you look at Amazon (AMZN) and you look at Microsoft.

We finally have a sort of activist FTC. They've looked at

this issue of innovation being crushed by the big guys. And I think we're in

for two years, at least, or a year of more regulatory headaches for the big

guys. Maybe they just sort of flick it off because, it's a legal expense, and

they figure that they'll spend $1 billion on lawyers, and they won't even

flinch.

But I think that, when you talk about the big seven, I think

that Facebook and Google (GOOGL) have some real exposure between privacy and

between all of these other kinds of issues. I feel like Amazon, it would be the

greatest favor in the world if they would force Amazon to spin off AWS. It

would then have two trillion-dollar companies instead of one. They don't even

understand that AWS runs the government -- runs the back end of the government.

Fitz-Gerald - I know it. I mean, these are the same

folks who couldn't understand how to balance a checkbook as we came into the

credit default swap mess. So I share your perspective. I think Google has got

some serious regulatory issues. I think that the recent memo from their search

saying, hey, you guys got to work faster, is an attention getter for any

slacker who thinks they're going to get perks all day.

You better get serious because Google is going to have to

compete. But I worry that it's too little, too late. I think Amazon's got some

regulatory challenges. Certainly, the FTC's ire is building against them. I

know a lot of consumers are frustrated with the fact that, once again, their

data is being used in ways that they didn't sign up for, so they're being

product-ized without their knowledge or explicit consent. But I do also think

that it's going to prompt some unexpected consequences.

Mike, to your question, I think we're going to see offshore

markets blossom because companies like Apple (AAPL), Google, Microsoft and Meta are going to figure

out ways to go to more business-friendly environments. They won't take all of

their operations out there. But to Howard's point, they're certainly going to

adapt.

Tullman - Yeah. And I think when you talk about AI,

that's obviously a whole conversation. But I have a fantasy because I've run

call centers for years, and the shame of exporting a call center to India or

wherever, has to do with language.

And today we have tools. There's just no question in my mind

that somebody sitting in India who's a decent typist could respond to a

conversation in real time, in the voice of somebody from southern Omaha,

Nebraska, and you wouldn't be able to tell for one second that, that wasn't

somebody who was around the corner from you, as opposed to halfway across the

world. So, voice and even video assistants are going to change the way that we

interact with this new digital world. There's a quote that I saw recently

about, how crazy and ironic is it that the computer now asks us to prove that

we're humans.

Fitz-Gerald - The one that gets me is, I'm sitting here

working all day on whatever it is. I mean, we have multiple platforms in our

office, just like you do. And all of a sudden, one will say, hey, are you

human? You better verify your credentials. And the other is going to ask and

well, you got to do x, y, z. It's like, I've been working on both of your

ding-a-ling computer sets all day long, of course, I'm human.

Tullman - To me, my favorite wasted effort box is the

one that says click here if you want me to trust this monitor, you know, in

perpetuity, which means for 32 seconds because then it's gone. And then it's

like, oh, start over again.

Larson - So let's just bring back Clippy and everything

will be fine, right?

Fitz-Gerald - Yeah. There's a blast from the past,

right?

Tullman - I've been trying Copilot, and Microsoft is

creeping toward something that has some utility. But the issue is, it's really

funny because I don't know -- Mike, if you know, there's a sliding dial in most

of the ChatGPT systems now that says, "be more aggressive" or

"be less aggressive."

And I think, frankly, Clippy and all of these things were

examples of some engineer deciding just how invasive to be, instead of giving

us a level of control because each of us wants to sort of customize our

interaction with these tools.

Fitz-Gerald - And that raises a really interesting

point because if you look at how, for example, Steve Jobs came on the scene, he

didn't start with the tools or even the engineers. He just said, make it

useful, make it intuitive. And I think there's a good case to be made that many

of today's tech companies have failed in that regard.

So, the next big jump I'm looking for is going to be how do

we make these tools intuitive. I think the first company that really gets to

the point where we have seamless technology, a la Star Trek, for example, where

it really is an interactive consumer or user-driven experience is going to make

bank. I think we're maybe -- I mean, Howard, you got a better feel for this

than I do, but I think we're maybe five, ten years away from that max.

Tullman - Well, it's funny because in the last couple

of talks I've done for the MoneyShow, I've said, take a step back from a

particular industry or a particular kind of technology and ask yourself

basically four or five questions. Is it going to save me time? Is it going to

save me money? Is it going to make me more productive? Is it going to help me

make better decisions? Is it going to impact my health or my social status?

And honestly, that's the test that I think you need to start

with these days because we're also facing a consumer population. There was a

great article today that said it's just starting to dawn on us. And this is no

knock on Mike, who is a youngster...

Larson - I don't know if I'd go so far as to say a

youngster.

Tullman - But it's starting to dawn on us that the gap

between commentators has not moved down one decade. It hasn't gone from Dan

Rather to one of the -- I don't know, Norah or whatever her name is at CBS.

It's gone down 40 years. So, the people who are now interacting with that

generation aren't experienced leaders. They're not people who've earned their

spokes and their spurs for 20 years. They're kids, their peers.

And so the whole influencer culture and the whole TikTok

world has changed it. It's frightening. I mean, you see some of these kids

talking and you realize that they're from another planet.

Fitz-Gerald - Well, it's interesting to me from an

investing standpoint. Because we see that particularly when it comes to our

technology investments, when we're looking at companies, the way companies are

interpreted is uniquely a function of the lens that the interpreter is using.

And when we start talking about historical events that have

shaped where companies are now and their legacy is why they're dealing with

things, that's information that in many cases has been nothing more than a

history book entry to the young folks in our office who may or may not have

paid attention.

And when they start pulling that onion apart, and they start

delayering that, and they start realizing why Apple is what it is today, or why

Microsoft is what it is today, or why Tesla is what it is today, they're

shocked because history in their mind is nothing more than something on a page,

whereas older investors, older technologists, older people who are looking to

move the markets have lived that information.

So, I think it presents a unique set of opportunities. And

from a trading perspective or an investing standpoint, again, we see lots of

folks here who are video game generation who want nothing more than "Okay,

green light, buy, red light, sell." You can't do that anymore.

Tullman - I think you're lucky. You must be putting

Xanax or something in the water at your place because to have your analysts be

patient enough to look backwards at any of this history is shocking to me

because I think they have no rearview mirror at all.

Fitz-Gerald - Well, we don't let them escape that

because the investment philosophy that we bring to markets is very much one

that history may not repeat, but it rhymes. So, whether they like it or not, my

young analysts, they have got to read this stuff. If I'm honed in on some event

somewhere, they better figure it out because they know I'm going to ask a

question across a conference table. And if they don't have an answer for it,

I'm going to force them to go get one.

So it's a unique point in history, Mike. We're at a Q1 where

there's this day of reckoning according to many of the naysayers. But as

Howard, and I'll tell you, this isn't our first rodeo. Technology has never,

ever, in the history of the world stopped or failed to make innovation happen.

So, I think it's an exciting time to be an investor.

Tullman - I think it is as well. And I also think that

we're going into a period where we're going to have to deal with this issue of,

are four or five platforms going to control the entire space. And right now, I

just wrote a column about Ai, it's the same issue.

It's how many people, how many of these companies, can take

$10 billion from their P&L and make it invested in compute. And the answer

is maybe four or five. I mean, these little guys that are dancing around,

they're all going to be exactly like what happened in the game business.

They're going to live on top of the game machine.

So when I started as a game developer, we thought we would

build a game machine. And everybody was like, well, have you not heard of the

PlayStation, the Xbox, and Nintendo? And that was it. Then it was over. And now

you are simply a contributor above their layer. And I think in AI, because of

the war chests of these big guys, they're going to control the platforms for

the foreseeable future.

Larson - It's fascinating taking that sort of trip down

the historical memory, technological memory lane. I want to ask you, Keith, in

your case what you're seeing in the public markets and, Howard, in your case,

in the private market. You wrote something in Inc. recently that said, "As

the harsh realities of the post-pandemic digital economy sink in". And

then it went on to talk about some of the pressures that are impacting some of

these companies, and how people have to approach their business as founders and

on the other side as investors, slightly differently in the private markets.

Would you care to elaborate on that a little bit?

Tullman - To me, the biggest thing that I'm engaged in

right now with about 25 of our portfolio companies is, there's not a single one

that is looking to increase their bricks-and-mortar presence. Not a single one.

Every one of these guys is shrinking, and they're shrinking in two ways. One,

they're shrinking physically.

Nobody needs to show you a physical infrastructure in order

to convince you that they're real. And that's a mind shift. When we grew up,

the banks had these monumental facilities. Today they're an ATM or they're a

phone. So, number one is the shrinkage in terms of physical. But the second

thing is, we're going to have a four-day workweek pretty soon and half our

workforce or more is going to be remote, too. And then add on top of that the

gig economy that, probably a third to a half of the entire workforce in five

years is going to be independent contractors. Boy, everything that we think of

as a company is going to change radically. And that to me has huge

implications.

Larson - And then, Keith, to shift to the public

markets again, you look at how we came into this year and where we are now,

with a little bit of a shakeout. What are your thoughts on how investors should

approach that, right? Whether they're already heavily invested in tech or are

looking at this as maybe an opportunity to get more involved?

Fitz-Gerald - Well, to the point that Howard and I have

just sort of by discussion demonstrated is that history constantly moves

forward. Innovation constantly happens. And so the question is, how do you

really approach it, right? Anybody who thinks technology is going back in the

bottle shouldn't be in the financial markets. That genie is never going away.

We are creating more information faster and layering it upon

our lives in ways that we couldn't have imagined, 10, 15, 20 years ago. So

investing now is not a question of "Do I or Don't I?" like so many

people think. The question is, "How do I get a hold of it? How do I get in

front of what happens next? Which companies are going to get me there?"

And to our point earlier on, it's a very short list. You can

mess around with all the small stuff if you want, but that's going to be in the

private market. That's going to be a function of people like Howard who have

the expertise to help these folks move forward.

By the time it hits the public market, you want to have big,

strong balance sheets, massively successful management, the ability to protect

margins, making products and services that the world can't live without because

it's all about the layering. And paying attention to this short-term noise,

this is just nonsense to me. Quarterly earnings and digital companies do not

match up. What you've got to do is go a long cycle.

Tullman - And by the way, with our companies, what

we're telling them in addition to shrinking is "Build to be bought."

We're saying one in a trillion of you is going to be the next big win. But 50

of you out of 100, if you're prudent with managing your investors' money, can

give them a colossally attractive return in the next three to five years.

Fitz-Gerald - Absolutely.

Tullman - What scares me is, unfortunately, that three-

to five-year window, which is a venture window, is not the kind of window for

investment that we need for environment, for climate, for medicine. And so,

we're going to need family offices, and we're going to need other sources of

capital to support a ten-year window if you want to change some of these areas

because the VC community doesn't even get it. I mean, they're not even focused

on this kind of stuff.

Fitz-Gerald - No, they're not. It's such a

dog-and-pony-show-driven lottery ticket mentality. It's interesting because

that comment of yours raises a memory in my memory banks -- all three of them

that I have left. Back in the early days in the '80s, we were very actively

involved in a lot of different things.

We learned some really interesting lessons from the junk

bond experience at that point in time. Michael Milken and Ivan Boesky, names

that went down in infamy, but it didn't deter from their brilliance. They told

me years and years ago, you got to buy 150 or 100 of these things, knowing that

99% of them are going to go feet up.

Tullman - It's optionality.

Fitz-Gerald - Big time. But the one that hits is going

to hit so big, you won't even believe it. And investing in tech right now is a

lot like that. If you're dealing with these small companies, you're coming

forward. You're going to position to be bought, you're going to do something

great. To Peter Thiel's words, you got to be 0 to 1. You can't be n plus one.

Tullman - Well, the other thing I would say is, and

I'll say this in the talk coming up, I'm not sure that with yields at five-plus

percent with 100% safety, that a typical MoneyShow investor ought not to be

saying, I'm going to take X percent, and I'm going to protect it because that

kind of yield is reasonably safe, and it's attractive. Then I may roll a 10th

of my portfolio into something like Bitcoin. Because the last MoneyShow we had

in Vegas, I thought the guy was tremendously compelling about Bitcoin, and

purely Bitcoin, not crypto generally and whatever. But the halving has occurred

and we didn't see the bump.

Historically, there's been a bump. We'll see going forward

whether crypto changes or not. But I think that the real scary thing is we're

going to have such a storm of grief in the next six months before this

election. I just think that the people are going to turn off. And I suspect

that we're going to even see that in the market. That people are just seeing

too much noise, too much drama, too much confusion.

So I think we're going to see a fair amount of investors

just park, and if you're going to park in tech, you better park in these big

guys because they may move in a small range, but you could have a company go to

zero if it's one of these little guys.

Fitz-Gerald - That's a really interesting thing. I

mean, my take on this is, chaos produces opportunity. So personally, as

upsetting as I find our politics at the moment, I do money and my job is to

help our investors, our clients around the world figure that out. So, chaos to

us is opportunity.

You got to pick it right. You got to pick it safely. You got

to pick it with confidence. But you always play offense, and parking is an

offensive decision. Because if you decide how you're going to park it, why are

you going to park it, and the conditions at which you come back out of the

garage or out of the bank, do you know what, you've won. So, to me, that's an

advantage.

Tullman - I talked to a bunch of the investors at the

last conference, and they were surprisingly defensive in the sense of, I'm

going to be sure I hang on to mine in these bumpy waters. But you know, when

Amazon moved up to become a part of the S&P, it strikes me that it

diminished the range of viability.

In other words, the wings were going to be less, which makes

it even safer. I mean, it just makes it...

Fitz-Gerald - Yes, and it also attracted a lot of

institutional portfolios. Because when you get something like that, what we

know from our side is that once you start to get involved, many of those shares

are never going to see the light of day again. They have to be there because of

allocations, because of defined benefit plans, endowments, pension funds,

whatever. They have to have names in the portfolio and on the list.

Tullman - Exactly, exactly. I agree with that.

Larson - I'll tell you, sometimes it's so easy hosting

one of these things. You just let the smart people talk and stay out of the

way. So, this has been fascinating. But I do want to say, in the time that we

have left, obviously we're speaking because you're both going to be joining us

for the Investment Masters Symposium Silicon Valley. It's May 7th to 9th.

Beyond what you've already shared, is there a sneak peek or

any nuggets of wisdom you want to tell people that they're going to hear more

about when you join us in May?

Fitz-Gerald - Listen to Howard.

Tullman - Okay. All I would say is that, we're five

years from AI making a serious impact in the business operations of 90% of the

businesses out there, notwithstanding what the business management thinks. It's

just not coming that soon. Now, machine learning is a completely different

thing. I mean, we're behind the curve on machine learning.

Everybody with this amount of data flow going on should be

experts at customer management, all this kind of stuff. But pure AI is down the

road. And when you see a company shoveling a bunch of money, it's cosmetic. And

that to me is bad management.

Fitz-Gerald - Interesting. Well, Howard and I are going

to have a good discussion on stage because I think it's sooner than five years.

But I do go down into the machine stack because the amount of data is an

opportunity. The question is, what do you do with it and how do you do it when

you get here.

But if we know anything from investing, get your money there

first. Get with the right companies and hold on for dear life because like a

rodeo, you want to make it all the way to the buzzer.

Larson - Great. I think that's a great place to wrap

things up. Howard and Keith, thank you so much for joining.

Originally published on MoneyShow.com

LINKS TO RELATED SITES

- My Personal Website

- HAT Speaker Website

- My INC. Blog Posts

- My THREADS profile

- My Wikipedia Page

- My LinkedIn Page

- My Facebook Page

- My X/Twitter Page

- My Instagram Page

- My ABOUT.ME page

- G2T3V, LLC Site

- G2T3V page on LinkedIn

- G2T3V, LLC Facebook Page

- My Channel on YOUTUBE

- My Videos on VIMEO

- My Boards on Pinterest

- My Site on Mastodon

- My Site on Substack

- My Site on Post

LINKS TO RELATED BUSINESSES

- 1871 - Where Digital Startups Get Their Start

- AskWhai

- Baloonr

- BCV Social

- ConceptDrop (Now Nexus AI)

- Cubii

- Dumbstruck

- Gather Voices

- Genivity

- Georama (now QualSights)

- GetSet

- HighTower Advisors

- Holberg Financial

- Indiegogo

- Keeeb

- Kitchfix

- KnowledgeHound

- Landscape Hub

- Lisa App

- Magic Cube

- MagicTags/THYNG

- Mile Auto

- Packback Books

- Peanut Butter

- Philo Broadcasting

- Popular Pays

- Selfie

- SnapSheet

- SomruS

- SPOTHERO

- SquareOffs

- Tempesta Media

- THYNG

- Tock

- Upshow

- Vehcon

- Xaptum

Total Pageviews

GOOGLE ANALYTICS

Blog Archive

-

▼

2024

(346)

-

▼

April

(81)

- Marjorie Taylor Greene is the sort of clod who cou...

- Flatulent Fraud

- TRUMP WILL SELF-DESTRUCT

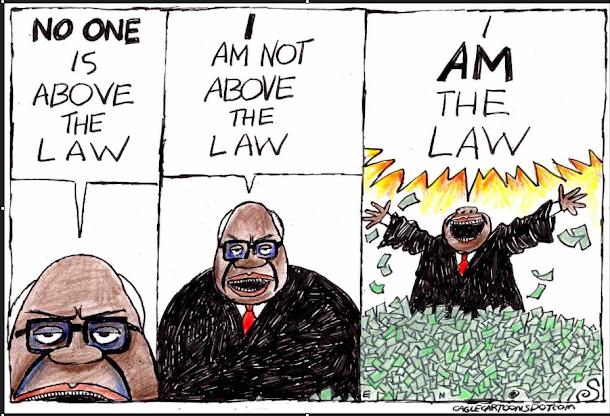

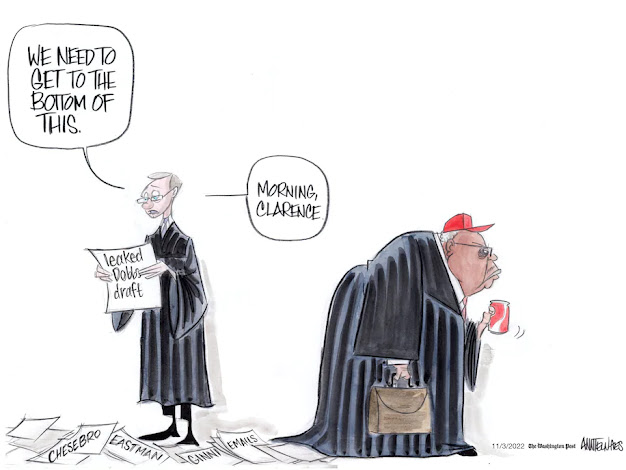

- CLARENCE NEEDS TO QUIT - HE'S A CORRUPT CROOK

- THIS CROOK COULDN'T RUN A DAIRY QUEEN

- Gaza ‘solidarity encampment’ shakes up Northwester...

- Antisemitism at Columbia University Is a Disgrace

- Tullman And Fitz-Gerald Talk Tech: Capitalize On T...

- No One Has a Right to Protest in My Home

- THE ROBERTS COURT

- TRUMP TRIAL

- A new set of ‘Four Questions’ for anti-Israel prot...

- MoneyMasters Podcast from the MONEYSHOW

- RARING TO GO - TIME FOR HIS MORNING NAP

- NEW INC. MAGAZINE COLUMN FROM HOWARD TULLMAN

- TRUMP WORRIED ABOUT PECKER LEAKING

- They Were Assaulted on Campus for Being Jews

- Trump is a Fat Flatulent Fraud

- THE PROM

- CINDERELLA

- Odor in the Court

- Gag the Lying Scumbag

- TRIUMPH ON THE TRUMP TRIAL

- Lame Lie of the Day

- MORON DEMOCRATS WHO ARE HAMAS TERRORIST SUPPORTERS

- GOOD FOR GOOGLE - IF ONLY THE COLLEGES HAD THE COJ...

- The Wit Sisters

- Style Icon

- HOWARD TULLMAN JOINS LISA DENT ON WGN RADIO

- LOOP NORTH NEWS

- Donald Trump’s Secret Shame About New York City

- Sleeping Ugly

- JOIN ME IN THE VALLEY FOR A GREAT UPCOMING EVENT

- SLEEPY DON and HIS SCUMBAG LAWYERS

- McCon Man - Wake Him When It's Over

- NEW INC. MAGAZINE COLUMN FROM HOWARD TULLMAN

- Unhinged

- Trump’s Willing Accomplice

- HARD TO BELIEVE WHAT FOOLS AND MORONS THESE MAGA R...

- We Lie

- Russian Dupe

- Judge on the Take

- WILL THE CUBS EVER GET IT TOGETHER AGAIN??

- He’s Mentally Ill

- IQ = 73

- Evidence

- CRAIN'S OP ED ON GAMING MORPHING INTO GAMBLING BY ...

- HOWARD TULLMAN JOINS LISA DENT ON WGN RADIO TO DIS...

- A CROOK WITHOUT SHAME

- A COMPLETE MORON AND A CRIMINAL

- NEW INC. MAGAZINE COLUMN FROM HOWARD TULLMAN

- MAGA SUCKERS KEEP FALLING FOR TRUMP'S LIES

- THE ENEMY?

- A Guide to the Trump Election Interference and Hus...

- Judge Cannon's ticking time bomb jury instructions

- Before Someone Steps In Donald Trump blows his d...

- JUDGE FOR SALE

- IT'S ALL ABOUT RUSSIA

- TRUMPENSTEIN

- Judge Aileen Cannon is Delaying Justice

- Join Me in the Valley for this Powerful Symposium

- TRUMP DEFENSE TEAM

- THE MAGAt PARTY

- HUCKSTER, SCAMMER AND TRAITOR

- HOWARD TULLMAN JOINS LISA DENT ON WGN RADIO TO DIS...

- Why Judge Aileen Cannon is on thin ice in Trump’s ...

- Jack Smith Takes Cannon to Law School

- TRUE WEDDING BLISS FOR TRUMP'S SLUTS

- RUSSIA MAKES FOOLS OF THESE CROOKS

- PSYCHO

- CHARITY CHEATERS AND OVERALL SCUMBAGS

- TRUMP LIES AND CONTINUES TO MAKE FOOLS OF THE MORO...

- RAPIST

- TrumpIsHiding is Trending - Trump is Nuts and The ...

- NEW INC. MAGAZINE COLUMN FROM HOWARD TULLMAN

- DJT

- 3 Crooked Perverts

- CONGRATS ON A BIG AND IMPORTANT WIN - LET'S TAKE O...

-

▼

April

(81)