Thursday, July 17, 2025

Wednesday, July 16, 2025

ROBERTS HELPED TO KILL DEMOCRACY

How

John Roberts Created the Anti-constitutional Monster Devouring Washington

From ushering in Citizens United to

granting presidents broad immunity, no one in the capital is more responsible

for Donald Trump’s destructive second term than the Supreme Court’s chief

justice.

June 16,

2025

Forgotten in the arc of John Roberts’s nearly two decades

as chief justice of the United States is his role, behind the scenes, to herald

the result in Citizens United v. Federal Election Commission. No,

he didn’t write the ruling that ushered in our current era of corporations and

billionaires buying the presidency of the United States and other offices. But

he can be credited with moving the chess pieces that made that sweeping

landmark, authored by Justice Anthony Kennedy, possible.

One version of the story finds Roberts so spooked by an

unpublished dissenting opinion by outgoing justice David Souter that the chief

moved heaven and earth so that that document would never see the light of day.

In it, Souter, a Republican and a big defender of

campaign finance laws, called out Roberts for twisting the Supreme Court’s own

internal rules to arrive at a far-reaching outcome in an otherwise small-bore

dispute—in this case, a decree that the First Amendment places no limits on

so-called “independent” corporate and union expenditures in our elections.

That’s not the legal question the Supreme Court had been

asked to decide. And so other versions of this palace intrigue find Souter

pleading with Roberts, and the rest of the court, to not overrule prior

precedents curbing the influence of money in politics—and to rehear the case so

that those precedents could get a second look and a fresh round of briefing and

argument. Souter got his parting gift: On the final day before the Supreme

Court broke for its summer break in June 2009, Roberts announced that the case

would be reargued at a later hearing. Immediately thereafter, as his last order

of business that day, the chief also announced “with sadness that this is the

last session in which our friend and colleague, Justice David Souter, will be

on the bench with us.” Problem solved. By the next January, Citizens

United would become the law of the land.

“One

element Roberts didn’t foresee was that Trump wouldn’t be the only one with

pitchforks out against judges.”

This is but one data point for how Roberts, more than any

other politician in the United States, has set the stage for Donald Trump’s

disruptive second presidency—one far more destructive than the first, and yet

distinct in kind from any other in modern history in that the president truly

feels unbound. And in advancing an extreme vision of presidential authority,

he’s no longer ruling over Washington and the nation as a lone head of state.

Instead, the executive power, which Article II of the Constitution vests in one president of the United

States, has been freely shared with billionaire and mega-millionaire ruling

partners, Elon Musk chief among them.

Trump’s Cabinet, the wealthiest in history, at least holds

legitimacy in that its members, like Linda McMahon and Howard Lutnick, were

approved by the Senate, as the founding document instructs. Not so Musk. The

Tesla and SpaceX chief, who donated a quarter-billion dollars to Trump’s

reelection effort and over time has received tens of billions in government

contracts from a multitude of agencies, operated in a constitutional vacuum,

largely unconstrained by law or rules of ethics. As the leader of the inaptly

named Department of Government Efficiency, which is neither a congressionally

approved department nor efficient by established metrics, Musk—who recently split with the

president—was allowed to wield a breathtaking level of authority over the

executive departments and other agencies he’s beholden to, above and beyond

that of the Cabinet itself.

Much of this unchecked lawlessness is water under the

bridge by now, as judges, save some exceptions, have been too slow to stop the

bleeding or police abuses, whether that be funding cuts Congress never approved

or shocks to the federal workforce. Sensing early on how this unholy alliance

of money and power flew in the face of rules Roberts and his court have erected

for “officers of the United States,” as spelled out in the constitutional text,

a group of Democratic attorneys general cried foul in federal court: “Although

our constitutional system was designed to prevent the abuses of an 18th-century

monarch, the instruments of unchecked power are no less dangerous in the hands

of a 21st-century tech baron.”

One can only wonder what Roberts thinks of a duly elected

chief executive and an unelected de facto prime minister leading the charge on

mass firings across federal agencies, dismantling decades-old departments, and

impounding appropriations that by definition are already the law. Roberts’s own

branch of government is not exempt from DOGE’s intrusions; judges, law clerks,

and court employees have all been put on high alert over the Trump

administration’s documented encroachment even

on day-to-day court operations.

Bottom of

Form

These breaches of the separation of powers, both real and

imagined, and the anti-constitutional monster spreading its tentacles across

Washington, would’ve horrified the

Founders. But that’s yet another consequence of unlimited wealth corrupting our

politics. Democracy gives way to an oligarchy; that, in turn, may buy you a

quasi-monarchy with few guardrails. Roberts and the other justices responsible

for Citizens United may well believe that “independent

expenditures do not give rise to corruption or the appearance of corruption,”

as they insisted at the time. The Trump-Musk reign of chaos has put that idea,

fanciful then and now, to rest.

This corrupt bargain should haunt Roberts in other ways.

During the presidential transition, as if anticipating the legal resistance to

the incoming Trump administration, the chief saw the future when he dedicated

his year-end report on

the federal judiciary to the threats to their independence judges face

day-to-day. The report, which doesn’t mention Trump by name, is nonetheless

replete with not-so-veiled allusions to what the president and his supporters

have visited upon judges since he took office—including threats of violence,

intimidation, and disinformation about what individual court rulings mean or

require. “These dangerous suggestions, however sporadic,” he wrote, “must be

soundly rejected.”

Defiance, which has been a theme of the past six months,

hasn’t abated. And that’s because one element Roberts didn’t foresee was that

Trump wouldn’t be the only one with pitchforks out against judges. Musk, other

administration officials, and far-right figures who have grown in influence on

X and in the president’s circle have also joined this high-tech lynching, to

borrow from Clarence Thomas. When an incensed Stephen Miller grossly misrepresented a

Supreme Court ruling that urged the Trump administration to “facilitate” the

release of Kilmar Abrego Garcia, a Maryland man who had been unlawfully sent

back to a prison in his native El Salvador, that only set the stage for more

defiance by the White House.

In that

case, as in other politically charged cases, Trump has been on the losing side

in the courts. And the more he loses, the fiercer his and his supporters’

attacks on judges get. Indeed, a Reuters investigation in May found that John J.

McConnell Jr. and James Boasberg, chief judges of their respective federal

districts in Rhode Island and the District of Columbia, are top of the list

among federal judges “whose families have faced threats of violence or

harassment after they ruled against the new Trump administration.”

Roberts has tried to turn down the heat to little effect.

“For more than two centuries, it has been established that impeachment is not

an appropriate response to disagreement concerning a judicial decision,”

Roberts wrote in a statement in March as Boasberg phobia reached a fever pitch.

“The normal appellate review process exists for that purpose.” The attacks

didn’t relent. At a portrait unveiling in May

for John D. Bates, a George W. Bush appointee and yet another veteran judge

MAGA has viciously targeted for ruling against Trump, Roberts could be seen

sitting next to Boasberg and other members of the judiciary in

Washington—lending his presence and offering pleasantries in a roomful of

judges at a moment many of them feel under siege.

As it happens, many of these same judges, collectively,

presided over more than 1,000 prosecutions related to the January 6

insurrection at the Capitol. Then, as now, they’ve had to contend with an

emboldened right-wing fever swamp, led by the president of the United States,

that casts the rioters as political prisoners. The nation has Roberts to thank,

in part, for this attempt to rewrite the history of the assault on our

democracy: The chief led the way not only in granting Trump broad immunity over

his actions and inactions on that day; he also shielded him from the

insurrection clause of the 14th Amendment by blocking a bid by Colorado voters

to bar him from the ballot. Had Roberts not maneuvered to defang that

centerpiece of the post–Civil War amendments in this latter case, Trump might

have been ousted from public life for good.

In the face of all this aiding and abetting, Roberts’s

gestures and public comments in defense of judges come across as woefully

insufficient. Worse, they mask his hand in paving the way for Trump’s worst

excesses in just about every area of law and policy that matters to his

administration.

Fresh on the public’s mind is the Supreme Court’s

indefensible immunity decision, which effectively shut down a criminal trial

accusing Trump of masterminding his disruption of the transfer of power.

Roberts’s florid language in that ruling makes it plain that he believes the

president deserves special treatment as the head of one branch of government,

beyond the reach of the casual cruelty that everyone else faces in the criminal

system.

Yet the longer-term import of Trump v. United

States, as longtime scholars of executive power have observed, may be

how the Trump administration is embracing it today. In Trump’s

hands, the ruling isn’t just a shield from prosecution; it’s a weapon to

decimate the federal workforce, to dismantle agencies Republicans and business

interests have long disliked, and to fire independent watchdogs and regulators

Congress has seen fit to protect from White House interference.

Indeed, the idea that Article II of the Constitution gives

the president authority over every corner of the executive branch has long been

a Roberts hobbyhorse, and the Trump administration is riding it everywhere it

goes. When Trump unlawfully fired National Labor Relations Board member Gwynne

Wilcox, the first time in the history of the labor board that had happened, the

Justice Department relied on the immunity decision and others by Roberts to

justify the dismissal. The president’s firing authority is “untouchable by

Congress,” D. John Sauer, the solicitor general, told the Supreme Court in a

legal brief. And so the chief went right along and, acting on his own, quickly

allowed Wilcox’s firing to proceed. More than a month later, without bothering

to hear oral arguments, his majority ignored nearly a century of precedent and

gave Trump complete control over the NLRB’s leadership. “Today’s order,”

Justice Elena Kagan wrote in dissent,

“favors the president over our precedent.”

Carried

to its logical end, Roberts’s jurisprudence bolstering an all-powerful and

“energetic” president to do as he pleases spares no one: not the beloved

Librarian of Congress (fired), not the transformative Consumer Financial

Protection Bureau (fighting for its life), and certainly not the unlawfully

renditioned migrants disappeared to a notorious El Salvador prison (still

disappeared). In all these instances, the Trump administration can point to a

constitutional ruling by Roberts for justification. Even the Trump-led purge of

a government that is diverse, equitable, and inclusive, or part of its all-out

war against Harvard University, can be traced back to Roberts’s blinkered

thinking on race: “Eliminating racial discrimination means eliminating all of

it.”

Trump’s Washington is Roberts’s Washington. And the

greatest feat of the Supreme Court that bears their names may yet be the

wholesale destruction of government as we know it. In one executive order that

garnered little attention, Trump directed his

agencies on a “review-and-repeal” rampage to get rid of rules of governance

that have long been on the books. The source for this directive? Ten

cherry-picked decisions, all but one of them issued by Roberts’s majority or

supermajority—covering everything from affirmative action policies to

environmental law to religion in public life—that the administration thinks

should carry the day. It’s too early to tell where this slash-and-burn campaign

will end up. But if nearly 20 years of Roberts have taught us anything, it is

that once he rules, the nation is left to figure out how to fix what he has

broken. If it can be fixed at all.

Tuesday, July 15, 2025

NEW INC. MAGAZINE COLUMN FROM HOWARD TULLMAN

The 1 Crucial Innovation Lesson

Every Business Owner Should Learn From eBay

The

company I first encountered as a Pez dispenser trading post serves as a

fascinating case study for what businesses need to do to retain

users.

EXPERT OPINION BY HOWARD TULLMAN, GENERAL MANAGING PARTNER, G2T3V

AND CHICAGO HIGH TECH INVESTORS @HOWARDTULLMAN1

Jul 15,

2025

Having collected Pez

dispensers since I was a kid and having an embarrassingly large collection at

the age of 50 (which my daughters and granddaughters had no interest in), I was

excited to learn in 1995 about what came to be called eBay—an online auction platform where you could buy,

sell, and swap Pez dispensers relatively securely with total

strangers from anywhere in the country. I became one of its earliest and most

enthusiastic participants, bought and sold plenty of Pez, and made some new

friends along the way. I also had dozens of classic lunchboxes, but that’s

another story.

The eBay founders thought they were building a

marketplace for their friends and family. What they also created was an amazing

discovery tool whereby passionate collectors could find similar souls who

were just as crazy about these little plastic devices (and zillions of other

collectibles) as they were. Entrepreneurs are constantly trying to develop new

businesses and to create, exploit, and sustain demand and desires for their

products and services. The beauty of dealing with collectors of any kind is

that there’s already a built-in passion for the objects which the exchange

experience merely needs to facilitate, channel, and monetize. It’s always

easier to ride the horse in the direction it’s already headed.

Most people know some

version of the eBay origin story—founded by Pierre Omidyar as a side project to

help his girlfriend trade Pez dispensers online—and everyone knows that it grew

rapidly from an auction site into a global e-commerce marketplace because it

tapped into an underserved analog population and pulled those folks into the

digital age. The speed and scale of the immediate nationwide adoption was

amazing.

What far fewer people

appreciate is that eBay is yesterday’s news—cluttered, dated, and slow. It’s

afflicted with the same disease as one of Yogi Berra’s favorite restaurants:

It’s “so crowded that nobody goes there.” In an age where time is everything and

patience is scarce, eBay looks, operates, and feels like molasses. It turns out

that trying to be all things to everybody, fulfilling at best by FedEx, and

making its connections to its users a mile wide and an inch deep might have

been a great formula for volume and growth metrics, but over time, it made the

site cumbersome and unfocused.

These days, everyone

wants just what they’re looking for, right when they want it, and instantly

deliverable. EBay opted to go wide instead of deep and never really owned its

customers in a world where alternatives were only a click away. Without constant

change, innovation, and site improvements, eBay was never going to build

lasting connections, a committed community, or loyal long-term

users.

EBay opened the digital

marketplace but didn’t keep pace with the nature and needs of the new breed of

collectors—especially passionate sports fans who were searching for community

and interactivity as avidly as they were for commerce, and just as interested

in buying something scarce and brand new as they were in owning decades-old

hats, helmets, jerseys, shoes, and uniforms. It turns out that nostalgia is

totally pliable—collectors can long for products created in their youth just as

fervently as for goods unpacked and shipped yesterday.

These newbies weren’t

the hermits, housewives, cat ladies, and hoarders of old. They were millions of

solitary kids, DIY techies, and fanatical sports fans (often all three rolled

into one) who were looking to be a part of something that played to their passions,

connected them to their peers, and encouraged them to engage and participate.

Not surprisingly, the opportunity to create new venues and marketplaces to

serve today’s hordes of hyped-up young collectors and dramatically speed up and

streamline the buy-sell process was far too good a prospect to be overlooked

for long.

First eBay, then

e-sports

An early instance of the

demand for new experiences was the explosion of e-sports as a spectator event.

Although I never understood why watching others play a video game could be a

contagious and addictive experience, it’s clear that the next several generations

don’t agree. Starting in 2017, we saw whole stadiums like the Bird’s Nest in

China or the Barclay’s Center in Brooklyn converted into viewing venues where

players sat on a stage in front of computers while the gameplay was projected

on huge video screens throughout the entire space. Fans bought tickets,

merchandise, and gaming equipment, while millions of additional fans watched

the competitions at home online through Twitch or YouTube. These players and

viewers were ripe for the digitization and gamification of collecting and

online retail.

EBay created static

stores, but not stirring streams; illustrative images, but not live videos; and

collector interest, but not real-time excitement and interactivity. Text-based

auctions simply made no sense for the Twitch generation. The need for speed,

sound, and action was clear, so into the void stepped Fanatics Live, a

dedicated, live-streamed collectibles and trading card platform which moved

online retail to the next level and made it a gamified, community-based,

compelling experience. In some ways, Fanatics Live is just the newest

instance of the web’s ability to smash together context, connection, community,

and commerce.

Cameo was an

early case of connecting fans and followers (especially in sports) with their

favorite athletes, performers, and celebrities and monetizing the experience. Bemyfriends was

a platform provider offering bands and other acts the ability to build, own,

and control their own platforms, finances, and destiny by

owning the IP and also directly connecting with their fans.

And now, Fanatics Live

will enable the most entrepreneurial fans and fanatics alike to build their own

online mini businesses. The formula is simple—virtually no barriers to entry,

modest production costs, all underlying technology provided by third-party

platforms, immediate action and gratification, and a chance to make a decent

living on their own as well.

Fanatics Live reports

that there are already mini-merchants like Stephanie from MamaBreaks and

Joel from Soccercrds who are allegedly making six-figure

incomes while working from home. This is one impressive side of their

multi-channel marketplace. And to be very clear, the success of the overall

Fanatics Live venture will have a lot to do with the performance, professionalism,

integrity, and customer service provided by these micro-merchants.

But the most critical

metric—and the real path to the long-term success of this venture—is the

degree, depth, and scale of the engagement of the participants. Connecting

passionate peers to other peers thru real-time video events like card reveals

and pack openings; enabling direct chats between and among buyers, sellers and

traders; and facilitating swift and easy transactions create exceptional levels

of cost-effective engagement.

On a global basis,

Fanatics Live users spend more than an hour a day on the site, which is 25-30

percent longer than Instagram’s comparable numbers. More than 70 percent of the

Fanatics Live users take advantage of the chat feature, and this consistently

leads to sales. On a monthly basis, loyal and committed users make an average

of more than 15 transactions a month.

Letting the fans drive

the majority of the action and the transactions, relying on substantial amounts

of user generated content, turning motivated users into platform advocates, and

building positive word-of-mouth are all critical to inexpensive global expansion

and to consistent user retention. But all of this activity and goodwill is

predicated on a foundation of authenticity and trust which, like it or not, the

team at Fanatics Live will need to assure, adjudicate, and otherwise backstop,

just like Amazon regulates and manages its third-party vendors. It’s not an

easy undertaking, and I’m not sure that the guys running the Fanatics Live shop

understand that becoming referees is an inevitable part of the deal.

They’re focused at the

moment on generating buzz, growth, excitement, and millions of happy fans. But

in the long run, to stay in business, it’s far more important to be trusted than to be

loved—and much harder.

Monday, July 14, 2025

Trump’s Fans Forgive Him Everything. Why Not Epstein?

Michelle Goldberg

Trump’s Fans Forgive

Him Everything. Why Not Epstein?

July 14, 2025, 7:01 p.m. ET

Opinion Columnist

Over the last squalid

decade, many of us have let go of the hope that Donald Trump could do or say

anything to shake the faith of his ardent base. They’ve been largely unfazed by

boasts of sexual assault and porn star payoffs, an attempted coup and obscenely

self-enriching crypto schemes. They cheered wildly at his promises to build a

wall paid for by Mexico, then shrugged when it didn’t happen. The BBC reported on a 39-year-old Iranian immigrant whose

devotion to Trump endured even when she was put in ICE detention. “I will

support him until the day I die,” she said from lockup. “He’s making America

great again.”

So it’s been fascinating

to watch a vocal part of Trump’s movement revolt over his administration’s

handling of files from the case of Jeffrey Epstein, the sex-trafficking

financier who died in jail in 2019 in what was ruled a suicide. Running for

president, Trump promised to release the Epstein files, which some thought

would contain evidence of murder. “Yet another good reason to vote for Trump,”

Senator Mike Lee of Utah, a Republican, wrote on social media. “Americans

deserve to know why Epstein didn’t kill himself.”

Some of the influencers

who now staff Trump’s administration built their followings by spinning wild

stories about the case, promising revelations that would lay their enemies low.

Epstein’s client list “is going to rock the political world,” Dan Bongino, now

deputy director of the F.B.I., said in September. Appearing on Fox News in

February, Attorney General Pam Bondi was asked whether her department would

release “a list of Jeffrey Epstein’s clients.” She responded, “It’s sitting on

my desk right now to review.”

Now she says there was no such client

list. Last week, the Justice Department and the F.B.I. released a memo saying

that Epstein killed himself and no more information would be forthcoming: “It

is the determination of the Department of Justice and the Federal Bureau of

Investigation that no further disclosure would be appropriate or warranted.”

Trump has implored his followers to forget about Epstein, writing, in a

petulant Truth Social post, that the files were “written by Obama, Crooked

Hillary” and various other deep state foes. Let’s “not waste Time and Energy on

Jeffrey Epstein, somebody that nobody cares about,” he wrote.

But he was wrong: Lots

of people care. Trump’s followers responded to his attempt to wave Epstein away

with uncharacteristic fury and disappointment. Bongino has reportedly

threatened to resign over Bondi’s handling of the case. Epstein was a major

subject at Turning Point USA’s Student Action Summit, a conservative conference

that began on Friday. Speaking from the stage in Tampa, Fla., the comedian Dave

Smith accused Trump of actively covering up “a giant child rapist ring.” The

audience cheered and applauded.

Having nurtured

conspiracy theories for his entire political career, Trump suddenly seems in

danger of being consumed by one. In many ways it’s delicious to watch, but

there’s also reason for anxiety, because for some in Trump’s movement, this

setback is simply proof that they’re up against a conspiracy more powerful than

they’d ever imagined. “What we just learned is that dealing with the Epstein

Operation is above the President’s pay grade,” posted Bret Weinstein, an

evolutionary biologist and podcaster. An important question, going forward, is

who they decide is pulling the strings.

Epstein obsessives are

right to be suspicious about the weird turns the case has taken. So much about

it feels inexplicable, including the sweetheart plea deal Epstein got in 2008,

and the fact that he was apparently able to kill himself despite being one of

the most monitored inmates in the country. Even if it turns out that a review

of the case doesn’t implicate anyone who hasn’t already been charged, it should

be a scandal that Bondi misled the public about the existence of a client list.

But the administration

lies all the time — that alone doesn’t explain why this issue has so tested the

MAGA coalition. To understand why it’s such a crisis, you need to understand

the crucial role that Epstein plays in the mythologies buttressing MAGA. The

case is of equal interest to QAnon types, who see in Epstein’s crimes proof of

their conviction that networks of elite pedophiles have hijacked America, and

of right-wing critics of Israel, who are convinced that Epstein worked for the

Mossad, the country’s spy service.

Trumpism has always been premised on

the idea that he’s warring against dark, even satanic globalist forces, and

within the movement there’s a fierce yearning for the cathartic moment when

those forces will be exposed and vanquished. The Epstein files were supposed to

show the world, once and for all, the scale of the evil system that Trump’s

voters believe he is fighting. “Epstein is a key that picks the lock on so many

things,” Steve Bannon said at the Turning Point conference.

The way Trumpists have

made this case a cause célèbre can seem bizarre to outsiders. After all,

Trump’s friendship with the sex-trafficking financier has been widely

documented. Epstein’s best-known victim, Virginia Roberts Giuffre, said she was

recruited at Mar-a-Lago, Trump’s private club. And Trump has his own history of

alleged creepiness around underage girls; several teenage contestants in one of

his beauty pageants accused him of deliberately walking in on them when they

were undressed. As Senator Jon Ossoff, Democrat of Georgia, said at a rally

this weekend, “Did anyone really think the sexual predator president who used

to party with Jeffrey Epstein was going to release the Epstein files?”

But I’ve always seen the

fantasy of Trump as a warrior against sex trafficking as a way for his

followers to manage their cognitive dissonance about his obvious personal

degeneracy. To believe that they are on the side of light while championing a

man of such low character, Trump’s acolytes have had to conjure an enemy of

vast and titanic evil, and invent a version of Trump that never existed.

Among those on the right

who believe there’s an Epstein coverup, few seem to be entertaining the idea

that Trump is protecting himself. That, after all, would require a

re-evaluation of his integrity and their judgment. But they still take for

granted that Epstein was trafficking girls to powerful men and then

blackmailing them, and that he was killed so he couldn’t talk. Now they have to

figure out why Trump won’t give them the information they long for. The most

logical explanation, said Tucker Carlson on his podcast last week, is “that

intel services are at the very center of this story, U.S. and Israeli, and

they’re being protected.”

This notion has become

so widespread that Israel’s government tried to address it. “There is no

evidence — none — that Epstein was acting on behalf of the State of

Israel,” wrote the

Israeli minister Amichai Chikli in an open letter addressed to Turning Point’s

head, Charlie Kirk. But Chikli couldn’t resist using the case against his more

centrist political enemies, saying he wants to understand Epstein’s connection

to “former Israeli prime ministers Ehud Barak and Ehud Olmert, who both appear

in previously published Epstein-related documents.”

This will not, I suspect, put theories

about Epstein as a Zionist operative to bed. Without them, Trump’s followers

would have to admit they were duped, that MAGA has never been a Manichaean

battle against sex criminals, and Trump glommed onto the Epstein story only to

help him win an election.

The entanglement of the

Epstein drama with American debates about the Jewish state portends some dark

developments. I won’t pretend to know whether Epstein ever worked for the

Israelis, though I can’t imagine Trump covering for them at any cost to himself.

I’m worried, however, about people blaming Jews for the strange and

unresolvable parts of his sordid story. Scroll through X, and you’ll see they

already are.

It’s worth recalling the origin of the

phrase “cognitive dissonance,” which was coined in the 1950s by Leon Festinger,

an author of the book “When Prophecy Fails.” Festinger and his co-authors

studied an apocalyptic U.F.O. cult, with an eye to what happened when the

spaceship didn’t appear as predicted. Some members, disillusioned, left the

group. Most, however, maintained or redoubled their commitment. The problem for

Trump is that some of his followers need to choose between their commitment to

him, and to the narrative that justified his rise.

Sunday, July 13, 2025

Donny T. and Jeffrey E. - A Series of Unfortunate Events

Donny T. and Jeffrey E. - A Series of Unfortunate Events

The following is a detailed timeline of the relationship between Donald Trump and Jeffrey Epstein, including court documents, flight logs, little black books, masseuse lists, mugshots, and everything in between.

December 1985 - Donald Trump purchases Mar-a-Lago in Palm Beach, Florida.

1990 - Jeffrey Epstein purchases 358 El Brillo Way, 1.4 miles away.

This is the property where allegations against Epstein began, when the stepmother of a young teenager called the police after the girl came home with $300 in cash, claiming to have given Epstein a massage.

1990s - Jeffrey Epstein and Donald Trump develop a relationship that is all friendship, no business, but inevitably based on wealth.

1992 - Donald Trump hosts an exclusive party at Mar-a-Lago with more than two-dozen women flown in to "provide entertainment." The only guest is Jeffrey Epstein, who wasn't a paying member of the club.

“I arranged to have some contestants fly in. At the very first party, I said, ‘Who’s coming tonight? I have 28 girls coming.’ It was him and Epstein. I said, ‘Donald, this is supposed to be a party with V.I.P.s. You’re telling me it’s you and Epstein?’” - George Houraney, American Dream Enterprise

Early 1990s - Donald Trump reaches under Kristin Anderson's skirt at a Manhattan nightspot, touching her vagina through her underwear.

1993 - Donald Trump gropes former Miss Switzerland, Beatrice Keul, in the Plaza Hotel in New York City. Jeffrey Epstein later invites her to visit Trump at Mar-a-Lago.

1993 - Donald Trump gropes former Sports Illustrated model, Stacy Williams, in the presence of Jeffrey Epstein.

1993 - 1997 - Donald Trump's name appears seven times in the passenger logs of Epstein's private jet, according to House.gov.

1994 - Donald Trump and Jeffrey Epstein repeatedly rape a 13-year-old girl (pseudonym "Jane Doe" aka "Katie Johnson") at Epstein's NYC apartment. Read full court documents here.

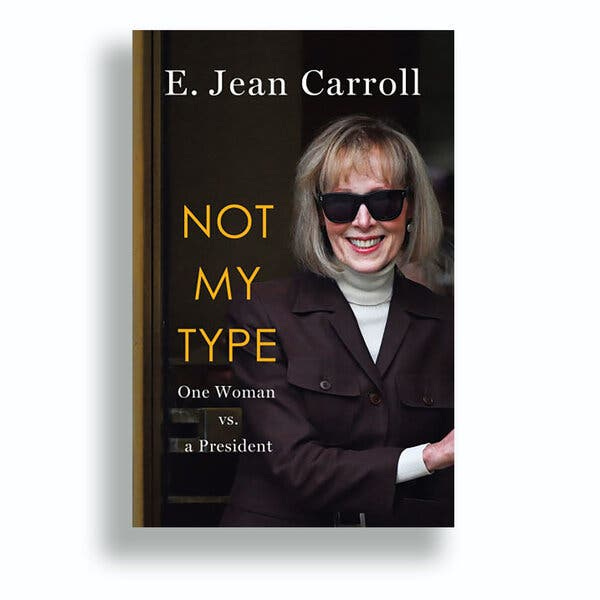

1995 - Donald Trump rapes E. Jean Carroll in a dressing room at Bergdorf Goodman in NYC. She later won a civil suit against him for $83.3 million.

1998 - Melania Knauss (b. “Melanija Knavs”) meets Donald Trump while working as a model in Manhattan.

"The first time he slept with her was on my plane." - Jeffrey Epstein

October 28, 2002 - Donald Trump gives an interview for New York Magazine, claiming to be a longtime friend of Jeffrey Epstein

"I've known Jeff for fifteen years. Terrific guy. He's a lot of fun to be with. It is even said that he likes beautiful women as much as I do, and many of them are on the younger side. No doubt about it, Jeffrey enjoys his social life." - Donald Trump, 2002

2004 - Donald Trump and Jeffrey Epstein fight over the coveted "Maison de l'Amitie" property in Palm Beach, each claiming that the other didn't have any money.

"It was something like Donald saying, 'You don’t want to do a deal with him, he doesn’t have the money,' while Epstein was saying, 'Donald is all talk. He doesn’t have the money.' They both really wanted it." - Joseph Luzinski, trustee

In the end Trump won, buying the property for $41.35 million. Four years later he'd sell it to Russian businessman Dmitry Rybolovlev for more than double.

October 20, 2005 - Palm Beach Police search Jeffrey Epstein’s residence after a report that he had sexually abused a minor. They seize several message pads from his kitchen that included two messages from Donald Trump. You can watch the walkthrough of Jeffrey Epstein’s house here.

July 27, 2006 - Jeffrey Epstein is first arrested by Palm Beach Police Department on charges of soliciting a prostitute.

2007/'08 - Donald Trump claims falling out with Epstein, banning him from Mar-a-Lago because Epstein allegedly harassed another member's teenage daughter.

"I had a falling out with him. I haven't spoken to him in 15 years. I was not a fan of his, that I can tell you." - Donald Trump, 2019

October 26, 2016 - Donald Trump pays adult film star Stormy Daniels $130,000 in hush money.

March 28, 2017 - Jeffrey Epstein poses for the New York State Sex Offender Registry

August 2017 - Jeffrey Epstein sits down with journalist and author Michael Wolff for over 100 hours of interviews, in which Epstein claims that Trump was his "closest friend." In the interviews Epstein says Trump was "charming" and "always fun," a great salesman, but a "serial cheat" and loved to "fuck the wives of his best friends." He goes on to say that Trump had friends but "was at heart a friendless man incapable of kindness." He also claims Trump had scalp-reduction surgery for baldness. When asked how Epstein knew all this he said, "I was Donald's closest friend for 10 years." The audio has never been released.

"I was Donald's closest friend for 10 years." - Jeffrey Epstein

July 8, 2019 - Jeffrey Epstein is arrested at Teterboro Airport in New Jersey on federal sex trafficking charges.

August 10, 2019 - Jeffrey Epstein kills himself in prison by hanging.

July 1, 2020 - Gawker publishes (2015) what is claimed to be Jeffrey Epstein's "Little Black Book," dated October 1, 1997 - 2004. Business Insider later publishes (2020) a searchable database with 1,749 names of public figures, celebrities, royalty and nobility, and statesmen. These are not necessarily people associated with criminal acts. The database includes Donald Trump.

April 2021 - Jeffrey Epstein’s 358 El Brillo Way mansion in Palm Beach is demolished.

February 21, 2025 - Attorney General Pam Bondi is interviewed on Fox News.

John Roberts: "The DOJ may be releasing the list of Jeffrey Epstein's clients? Will that really happen?"

Bondi: "It's sitting on my desk right now to review. That's been a directive by President Trump. I'm reviewing that."

February 27, 2025 - Attorney General Pam Bondi releases first phase of declassified Epstein files, including an evidence list, flight logs, a contact book, and masseuse list. Donald Trump is in the flight logs seven times, as well as the contact book. No second phase was ever released.

“Before you came into office, I requested the full and complete files related to Jeffrey Epstein. In response to this request, I received approximately 200 pages of documents, which consisted primarily of flight logs, Epstein's list of contacts, and a list of victims' names and phone numbers.” - Pam Bondi to Kash Patel

April 25, 2025 - Virginia Giuffre, who was allegedly trafficked by Jeffrey Epstein to Prince Andrew, Duke of York, takes her life.

June 5, 2025 - Elon Musk tweets that Donald Trump is in the Epstein files.

July 6, 2025 - The DOJ and FBI conclude Jeffrey Epstein had no client list and died by suicide. This was further evidenced by jail security footage.

July 9, 2025 - Trump lashes out at a reporter for asking questions about Jeffrey Epstein, further distancing himself from the investigation.

Court documents:

Jeffrey Epstein v. the United States of America

Jane Doe v. Donald J. Trump and Jeffrey E. Epstein

E. Jean Carrol v. Donald J. Trump

The People of the State of New York v. Donald J. Trump

United States of America v. Ghislaine Maxwell

Ellie is an author, editor, and owner of Red Pencil Transcripts, and works with filmmakers, podcasts, and journalists all over the world. She lives with her family just outside of New York City.

LINKS TO RELATED SITES

- My Personal Website

- HAT Speaker Website

- My INC. Blog Posts

- My THREADS profile

- My Wikipedia Page

- My LinkedIn Page

- My Facebook Page

- My X/Twitter Page

- My Instagram Page

- My ABOUT.ME page

- G2T3V, LLC Site

- G2T3V page on LinkedIn

- G2T3V, LLC Facebook Page

- My Channel on YOUTUBE

- My Videos on VIMEO

- My Boards on Pinterest

- My Site on Mastodon

- My Site on Substack

- My Site on Post

LINKS TO RELATED BUSINESSES

- 1871 - Where Digital Startups Get Their Start

- AskWhai

- Baloonr

- BCV Social

- ConceptDrop (Now Nexus AI)

- Cubii

- Dumbstruck

- Gather Voices

- Genivity

- Georama (now QualSights)

- GetSet

- HighTower Advisors

- Holberg Financial

- Indiegogo

- Keeeb

- Kitchfix

- KnowledgeHound

- Landscape Hub

- Lisa App

- Magic Cube

- MagicTags/THYNG

- Mile Auto

- Packback Books

- Peanut Butter

- Philo Broadcasting

- Popular Pays

- Selfie

- SnapSheet

- SomruS

- SPOTHERO

- SquareOffs

- Tempesta Media

- THYNG

- Tock

- Upshow

- Vehcon

- Xaptum

Total Pageviews

GOOGLE ANALYTICS

Blog Archive

-

▼

2025

(466)

-

▼

July

(44)

- HOWARD TULLMAN JOINS LISA DENT ON WGN RADIO TO DIS...

- Pimp My White House

- WHAT EVERY ENTREPRENEUR FEELS...

- ROBERTS HELPED TO KILL DEMOCRACY

- NEW INC. MAGAZINE COLUMN FROM HOWARD TULLMAN

- Trump’s Fans Forgive Him Everything. Why Not Epstein?

- WEAK AND PATHETIC - TRAITOR, RAPIST AND CONVICTED ...

- Donny T. and Jeffrey E. - A Series of Unfortunate ...

- JAIL THE CROOK

- NOEM NEEDS TO GO NOW - SHE'S THE WORST OF THE BUNC...

- BLONDY DOUCHEBAG

- LET'S DEPORT MELANIA NOW....

- TRUMP IS GOING INSANE RIGHT BEFORE OUR EYES

- STUPIDER THAN A BOX OF ROCKS

- FIRST PEDO ON THE EPSTEIN LIST

- Roberts Says Public Outrage Over SCOTUS Rulings Is...

- Trump’s Cabinet of Incompetents

- PEDOMAN - THE ORANGE FLYING TURD

- FAT FRAUDULENT FAILURE

- TRUMP IS A CHILD RAPIST AND A FILTHY LIAR

- S.E. CUPP

- ROBERTS IS A FOOL, A FAILURE, AND KILLING OUR DEMO...

- HOWARD TULLMAN JOINS LISA DENT ON WGN RADIO TO DIS...

- The Rules Have Changed: 10 Hard Truths from Howard...

- Guess Who Forgot to Tell Trump He Was Pausing Ukra...

- MARY TRUMP

- DON'T BELIEVE YOUR LYING EYES

- A NATIONAL DISASTER

- ASHA RANGAPPA Trump's TikTok Power Grab

- NEW INC. MAGAZINE COLUMN FROM HOWARD TULLMAN

- DAUGHTERS AND GRANDDAUGHTERS - AMAZING....THE BROW...

- 2025 FAMILY PHOTOS

- WELCOME TO THE MAFIA PRESIDENCY

- SAYS IT ALL

- HOWARD TULLMAN JOINS LISA DENT ON WGN RADIO TO DIS...

- HOW COULD WE HAVE SUNK SO LOW - CONVICTED FELON - ...

- SHAME AND COWARDICE

- FEEL FREE TO SHARE AND RECIRCULATE - IT'S TIME WE ...

- CRAPPY INDEPENDENCE DAY

- Trump’s Team Is Lying About Iran’s WM

- ERIK WEMPLE

- SARAH LONGWELL

- Trump Met With Congress And Didn't Know What Was I...

- ICE ASSHOLES

-

▼

July

(44)